The Intelligence Layer for Private Capital

Connecting your ecosystem of deals, diligence, LPs, and portfolio companies on a single, secure intelligence platform. We integrate with your fund administrator to provide operational leverage, not replace your system of record.

Asset Volume on Platform

Non- Custodial Architecture

Proprietary Financial AI Engines

Compliant Architecture || SOC2

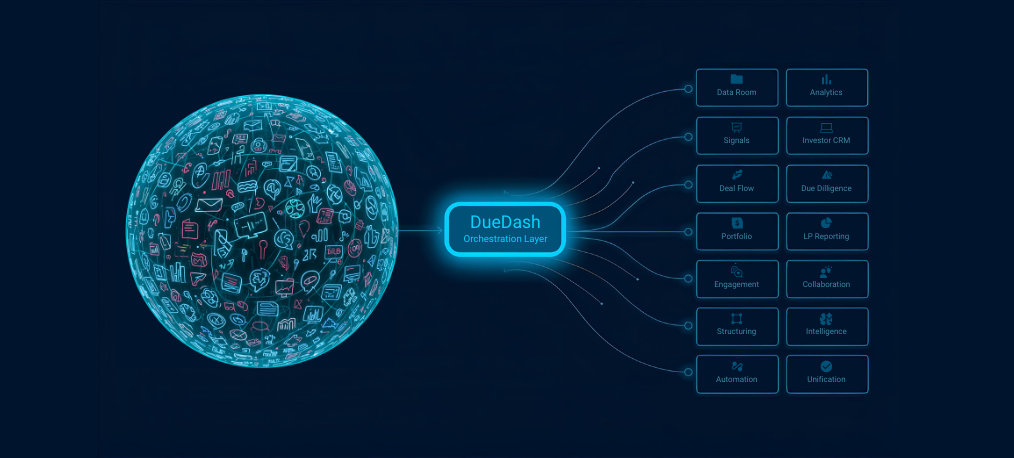

The Strategic Shift: From Chaos to Orchestration

The Tax of Manual Coordination

The private markets run on fragmented workflows. Deal flow lives in inboxes, diligence in scattered data rooms, and LP data in spreadsheets. This operational friction creates a drag on returns, multiplies risk, and limits your ability to scale.

Intelligent Infrastructure, Not Another System

DueDash is a non-disruptive layer that sits on top of your ecosystem. We provide the intelligent plumbing to automate workflows from teaser-to-close and beyond, allowing your team to focus on high-value decisions, not data entry.

Operational Leverage Through AI Orchestration

- Upto 75% reduction in diligence time

- Automated IC memo generation

- 10x deal Screening capacity

- Real-time portfolio monitoring

A Purpose-Built Architecture for the Entire Capital Lifecycle.

Two integrated layers that transform how you manage deals and capital operations.

Dealmaking Infrastructure (Layer 1)

For: Syndicate Leads, Intermediaries, and Deal Teams.

Function: We compress the "teaser-to-close" cycle. Our productized readiness kits, powered by AI agents, transform raw company data into institutional-grade deal packages, ready for distribution.

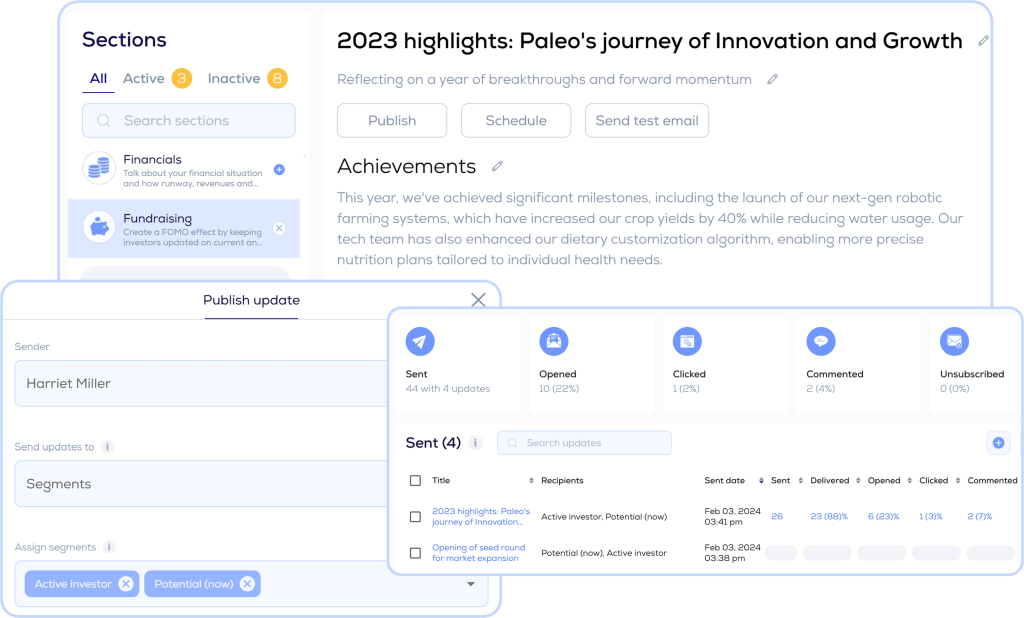

Capital Operations Infrastructure (Layer 2)

For: GPs, Family Offices, and Fund Managers.

Function: Once a deal is won, orchestrate LP onboarding, capital calls, and portfolio monitoring. Our platform provides the intelligence layer while your administrator remains the system of record.

Our proprietary AI agents are not generic wrappers. They are purpose-built engines trained to execute specific, high-value financial and legal tasks with precision and auditability.

Generates data-driven, IC-ready investment memo drafts from a data room in minutes, with source citations.

Scans legal and financial documents to red-flag non-standard terms, compliance gaps, and hidden risks.

Tracks portfolio company KPI health, flags variance against projections, and provides predictive alerts.

Schedule a confidential briefing to understand how the DueDash orchestration layer can be deployed to increase your firm's velocity and operational efficiency.

DueDash is not a broker-dealer, investment adviser, transfer agent, custodian, or placement agent and does not provide legal, tax, or investment advice. All document execution, KYC/KYB, cash movement, and registers are operated by the client’s appointed administrator or licensed partners. DueDash surfaces statuses and records an audit trail for coordination purposes only.